We use cookies on our website.

Some of them are necessary for the functioning of the site, but you can decide about others.

The Inflation Reduction Act (IRA), enacted in 2022, is a game-changer for homeowners. It offers historic incentives to combat climate change and make homes more energy efficient. Among its many provisions, the IRA introduces major rebates for homeowners to upgrade their electrical systems, enhance energy efficiency and adopt clean energy solutions. Let’s dive into the two key programs: the Home Electrification and Appliance Rebate (HEAR) and the Home Efficiency Rebate (HER) program.

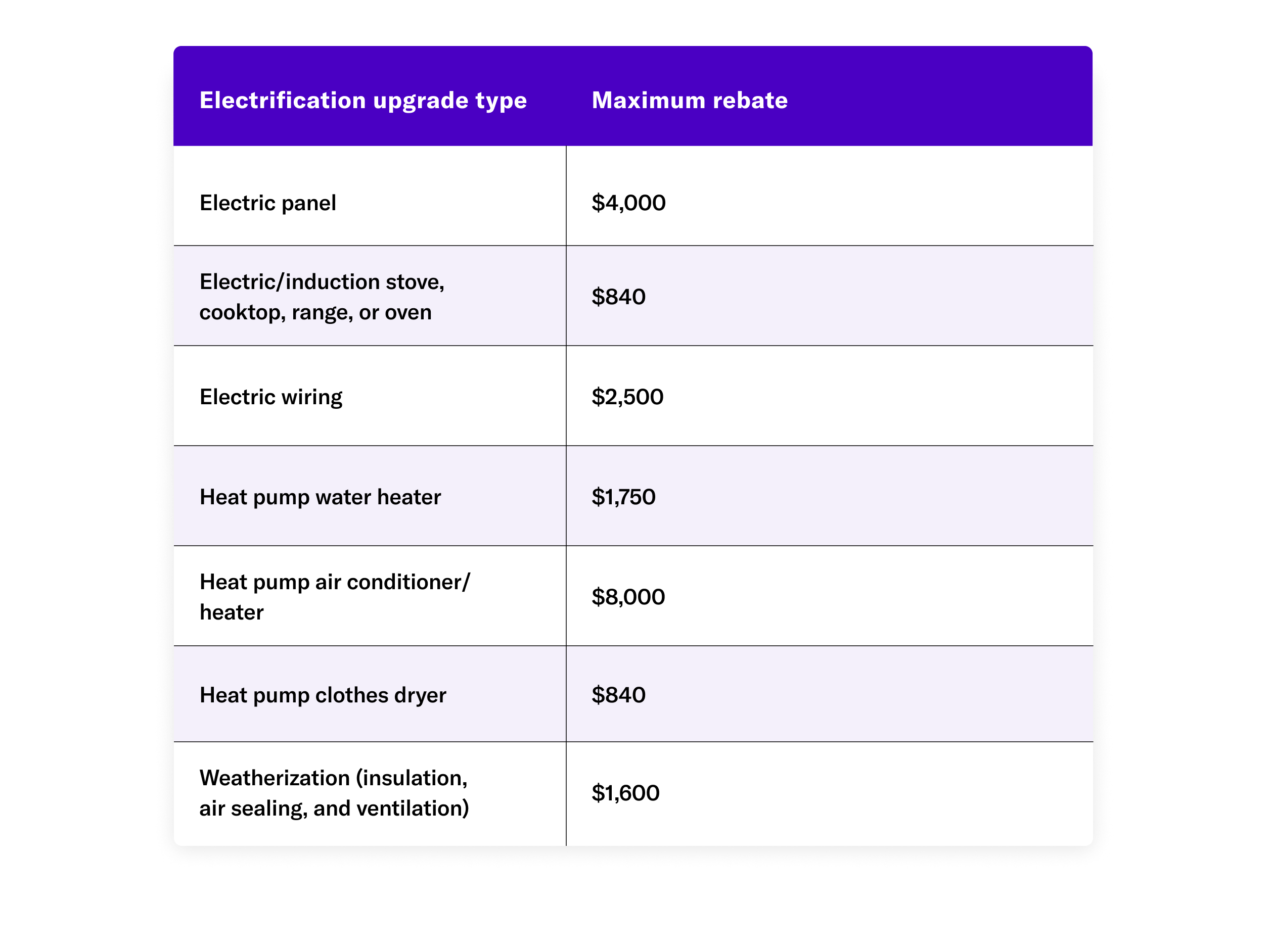

The HEAR program, formerly the High-Efficiency Electric Home Rebate Act (HEEHRA), provides upfront discounts for qualified electrification upgrades such as heat pumps, induction stoves and smart electrical panels. These rebates support low- and moderate-income households transitioning to energy-efficient, electric technologies. The HEAR program offers:

Moderate-income households (80-150% of area median income): Up to 50% of electrification project costs, capped at $14,000.

Different electrification upgrades have maximum rebate caps depending on the type of upgrade. Rewiring America has a helpful page that explains the program in detail.

Image: A chart of the maximum HEAR rebates available (Rewiring America).

The program also incentivizes contractors to perform electrification projects in LMI (low- and moderate-income) communities by offering contractors rebates of up to $500 per project.

The HER program, formerly known as HOMES, focuses on energy savings and efficiency. It offers rebates for retrofit projects like weatherization, space heating and cooling, and water heating that cut energy use by 20% or more:

These rebates double for low- and moderate-income households. The HER program is ideal for undertaking comprehensive energy efficiency retrofits. Rewiring America has a helpful page detailing this program as well.

In the context of the IRA rebate programs, “low-income" and “moderate-income" households are defined based on their income relative to the Area Median Income (AMI):

Moderate income: Households earning between 80% and 150% of the area median income (AMI). Using the same example, a household earning between $48,000 and $90,000 would be considered moderate-income.

For specific thresholds in your area, you can often find AMI information on your local housing authority or state energy department websites. Also, Rewiring America’s electrification savings calculator considers income level and can quickly determine what incentives a homeowner may qualify for.

The rollout of these rebate programs is state-specific, with each state tailoring the incentives to its unique needs, and the timing and specifics can vary quite a bit. Here is the latest status as of June 2024:

Most states expect to launch rebate programs by 2025, focusing on low- and moderate-income homeowners. However, eligibility, covered projects and rebate structures will vary by state. To keep track of program rollout state-by-state, go to the Department of Energy’s (DOE) Home Energy Rebates page.

Homeowners looking to upgrade their electrical panels as part of an electrification, clean energy or energy efficiency project can benefit significantly from these incentives. Lumin’s smart panel isn’t just any upgrade—it can retrofit to any existing setup, making the installation smoother and less disruptive than a full panel replacement. Plus, its load management features can help optimize clean energy investments and maximize homeowner energy savings.

Depending on income level and the project's specifics, homeowners could receive substantial rebates for electrical work. For example, low-income households can get up to $4,000 back for a panel upgrade under the HEAR program. Even moderate-income households can see significant savings, up to $2,000. Alternatively, if an electrical panel upgrade is combined with an energy efficiency retrofit project, such as weatherizing or upgrading to energy-efficient appliances, the HER rebates can provide nearly double those amounts.

Additionally, homeowners can combine IRA rebates with existing federal tax credits:

While homeowners can’t combine these two tax credits or the two IRA rebates for the same service, they can pair one of the tax credits with one of the IRA rebates for increased savings.

In short, there are some fantastic opportunities to help homeowners embrace sustainability and save money. Check your state’s rollout plans, look into these credits and rebates, and consider how an upgrade like the Lumin Smart Panel can be a force multiplier for home improvement projects.

To maximize available incentives for home upgrades, Rewiring America provides some of the most helpful resources: